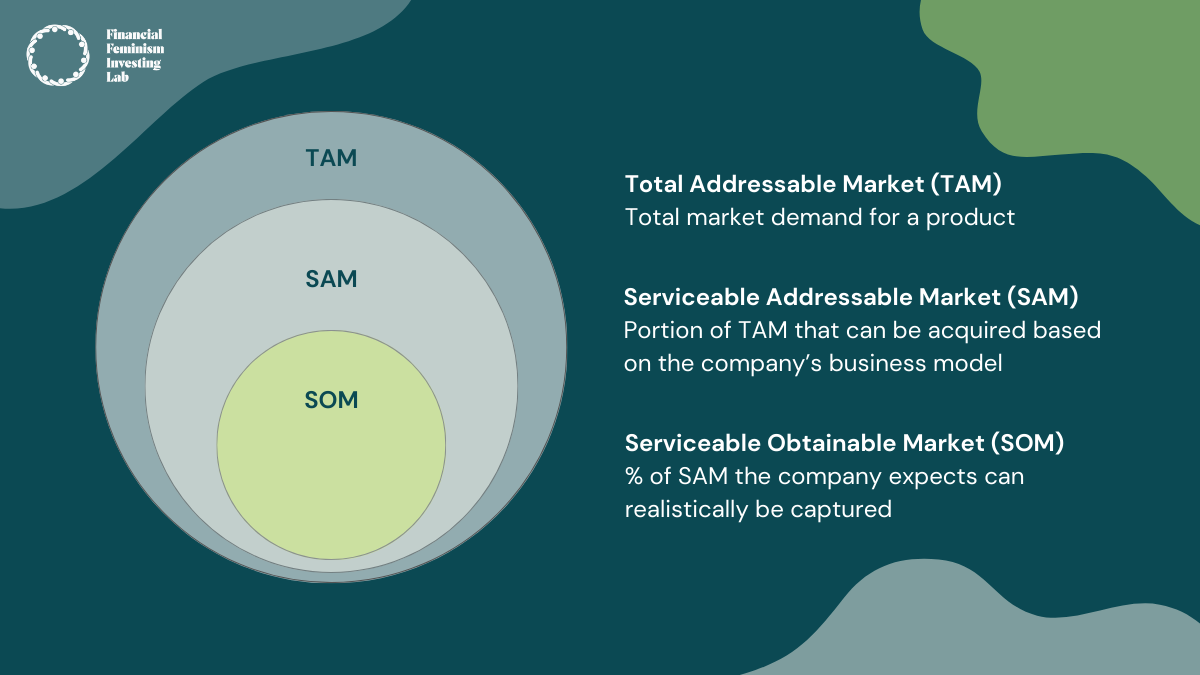

TAM SAM SOM: What They Mean and Why They Matter

3 x three-letter acronyms with big meaning: TAM, SAM, and SOM.

Understanding the potential and characteristics of market size is a critical step for early-stage companies to grow and thrive (or even just survive). Here's a breakdown of TAM, SAM, and SOM, and how these concepts guide everything from setting short- and medium-term goals to product development to pitching to investors.

Let’s get into understanding a business's market potential.

What is TAM?

TAM stands for Total Addressable Market.

The maximum potential demand of a specific market.

This is the total revenue opportunity available if a product or service could achieve 100% market share. TAM is the largest market size estimation and provides a macro-level view of the potential for a business or product.

Think of it like looking at the entire universe of potential customers who could use a product—regardless of how realistic it is for the company to reach them. A “pie in the sky” number, if you will.

For example, imagine a women-led business launching a co-working space. The TAM would include all individuals who need co-working spaces, regardless of gender or industry, across the entire market.

Why is TAM Important?

Understanding TAM helps investors and entrepreneurs gauge the overall potential of a business. A large TAM indicates a significant opportunity, but it's important to remember that a big number doesn't guarantee success. It's simply a starting point to understand the scale of the market and whether the business could eventually tap into that potential.

What is SAM?

SAM stands for Serviceable Addressable Market.

The size of the TAM you can reasonably target as you build your audience.

This is the portion of TAM that a company can realistically target based on its product, geography, or other limitations. In other words, SAM is the market that a business can actually reach with its current business model and resources.

Continuing with the women-led co-working space example, SAM narrows down to women professionals and entrepreneurs who are seeking co-working spaces that provide a supportive and inclusive environment tailored to their needs.

Why is SAM Important?

SAM is more refined than TAM and paints a clearer picture of the market that a business can realistically capture. It helps in understanding the competition, market saturation, and customer needs within a more defined scope. Investors look at SAM to assess the immediate opportunities and challenges a company might face in its growth journey.

What is SOM?

SOM stands for Serviceable Obtainable Market.

The size of the SAM you can potentially convert.

This is the segment of the SAM that a company can realistically capture in the short to medium term. SOM is the most specific and targeted of the three, reflecting the company's realistic goals based on its current resources, strategies, and competition.

In our women-led co-working space example, the SOM represents the realistic share of women professionals and entrepreneurs that the co-working space could attract and serve within its local area or target demographic, considering its unique value proposition and market presence.

Why is SOM Important?

SOM aids in understanding the near-term revenue potential of a business. It reflects the company's actual goals and growth strategy. Investors pay close attention to SOM because it indicates the market share the company can realistically achieve, helping to set expectations for revenue and growth.

Bonus: What is Beachhead?

The smallest market for the product/service and focusing on winning that smallest market to turn it into a stronghold before entering the broader market.

You may have heard the term Beachhead floating around, so what’s that all about?

The approach comes from military strategy and refers to the initial foothold a company secures in a market before expanding further. In business terms, a beachhead market is a small, focused segment that a company targets first to establish a strong presence and prove its business model. Once the company gains traction in this initial market, it can then expand to other segments, using its early success as leverage.

Back to our women-led co-working space example: To establish a strong foothold, the co-working space would identify a specific niche within the SOM to target first. For example, the initial beachhead market might be women-led tech startups in a particular city. By focusing on this specific group, the co-working space can build a strong reputation and network, creating a solid foundation before expanding to other niches or broader markets.

Why is Beachhead Important?

The beachhead strategy is beneficial for startups and early-stage companies because it allows them to focus their limited resources on a specific, high-potential area. Beyond minimizing risk by enabling the company to test its product and market approach in a controlled environment, it sets a solid foundation for scalable success. Investors often view a well-executed beachhead strategy as a predictor of future success and scalability. When done right, it can lead to faster growth, increased market share, and a stronger competitive position.

Why TAM, SAM, and SOM Matter for Investors

For investors, TAM, SAM, and SOM are more than just numbers—they're tools to assess the potential and risks associated with an investment. Here's why these metrics matter:

Strategic Planning: Companies use TAM, SAM, and SOM to develop growth strategies, allocate resources, and set realistic goals. As an investor, understanding these metrics helps you evaluate whether a company's strategy is sound and achievable.

Risk Assessment: A large TAM with a small SOM might indicate a crowded market with significant competition. Conversely, a large SOM relative to TAM could signal a strong market position but also suggest limited growth potential. Investors use these insights to balance risk and reward.

Valuation: Investors often use TAM, SAM, and SOM in their financial models to estimate future revenues and company valuation. Understanding these metrics allows you to make more informed decisions about the potential return on your investment.

TAM, SAM, and SOM are key components in an investor toolkit. They provide a framework for understanding a company's market potential and guide strategic decisions that drive real impact.

Whether you're looking to start backing ideas you believe in or you’ve already got a few deals under your belt and looking to explore new markets, these metrics are vital in assessing where your investments can make the most significant difference.

Explore more early-stage investing insights on our blog or download our mini eBook: A Guide to Evaluating the Market Potential of a Startup: Insights from Industry Experts.

Join us live to build your investor toolkit in our free How To Webinar Series or the upcoming Financial Feminism Investing Lab.

*Please note that the information provided in this blog is for informational purposes only and should not be construed as investment or financial advice.