How Can Agriculture Boost Global GDP?

Agriculture stands at the forefront of economic transformation. As one of the oldest industries, the sector has radically transformed over the years—from advances in machinery that expand the scale, speed, and productivity of farm equipment to improved seeds, irrigation, and fertilizers that help farmers increase yields.

The intersection of food and agriculture technology (agtech) offers vast opportunities. According to McKinsey & Co., agricultural connectivity could unlock more than $500 billion in GDP by 2030—one of just seven sectors that, fueled by advanced connectivity, will contribute $2 trillion to $3 trillion in additional value to global GDP over the next decade.

By embracing a digital, connectivity-fueled future that upgrades decision making in the field, agriculture can not only feed the world but boost GDP through innovation, impact investing, and supporting underrepresented entrepreneurs.

The Role of Agriculture in the Economy

As a cornerstone of the global economy, agriculture provides food security, employment, and raw materials. But as the industry evolves, it's no longer just about traditional farming.

Modern agriculture today integrates technology, sustainability, and innovation, positioning it as a critical driver of economic growth. As the sector continues to evolve, the adoption of cutting-edge technologies becomes essential to meeting global food demands and driving economic expansion. With advancements like precision farming and biotechnology, the food and agriculture sector has the potential to significantly boost GDP.

In 2023 in Canada, the whole agriculture and agri-food system:

employed 2.3 million people

provided 1 in 9 jobs in Canada

generated $150.0 billion (around 7%) of Canada's GDP

Zooming out, agriculture accounts for about 4% of global GDP, and in some of the least developed countries, it contributes more than 25% of GDP.

Agtech: The Future of Food and Farming

The agtech industry is revolutionizing how we grow, process, and distribute food. By incorporating advanced technologies such as AI, IoT, and robotics, agtech is increasing efficiency, reducing waste, and improving yield quality. This not only enhances food security but also creates new market opportunities for investors and entrepreneurs.

Investing in food and agriculture tech startups has the potential to generate substantial economic gains. For instance, innovations in crop management and food processing can increase productivity, reduce costs, and create jobs. As these technologies scale, they contribute to the GDP by stimulating related industries, from manufacturing to logistics.

Impact Investing in Food and Agriculture

Impact investing in the food and agriculture sector is gaining momentum as more investors seek to align their portfolios with their values. The global food supply faces some of the world’s biggest challenges—challenges that technology is poised to solve. Food technology startups operate in markets where even a 0.5% to 1% market share represents significant value in the trillions for global food services.

Impact investors measure their success not only in dollars but also in terms of their contribution to a better world, focused on generating positive social and environmental outcomes alongside financial returns. And that’s proving to be favourable: 79% of impact investors report their financial performance meets or exceeds their targets, and 88% report that impact performance meets or exceeds their impact targets.

In agriculture, impact investing can drive the adoption of sustainable practices, improve food security, and support the growth of diverse entrepreneurs who bring innovative solutions to the table.

For example, investments in organic farming, sustainable supply chains, and regenerative agriculture not only benefit the environment but also open new markets and improve community resilience. By channeling capital into these areas, impact investors can play a crucial role in shaping a more sustainable and equitable food system, which in turn contributes to overall economic growth.

The Role of Venture Capital in Driving Growth

Venture capital is a powerful engine for innovation, especially in sectors like food and agtech where new technologies can disrupt traditional practices and create significant value. Early-stage investors who back promising startups in this space not only provide the necessary funding but also help accelerate the development and commercialization of new products and services.

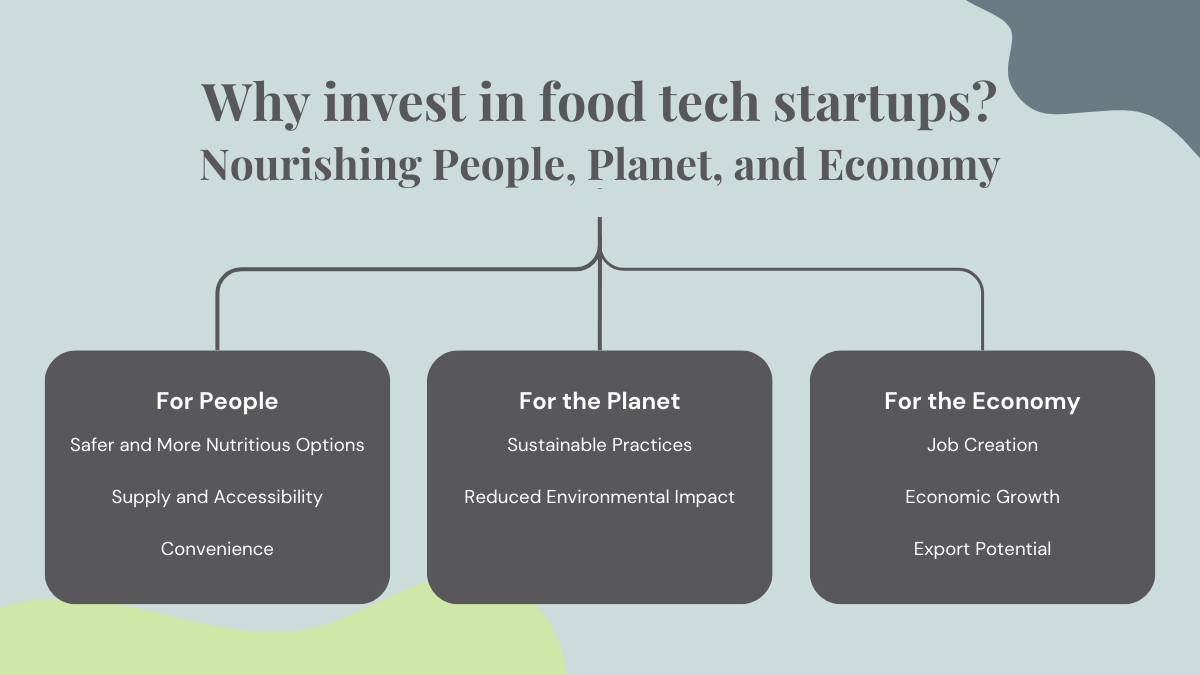

In the food and agtech industry, venture capital can drive growth by supporting companies that develop solutions for challenges such as climate change, food security, and resource efficiency. By investing in these startups, venture capitalists can help bring cutting-edge technologies to market, create jobs, and foster economic development—nourishing people, the planet, and the economy.

Moreover, as more women and underrepresented entrepreneurs enter the food and agtech space, there is a growing need for venture capital to support these diverse founders. By ensuring that capital is accessible to a broader range of entrepreneurs, the industry can tap into a wider pool of ideas and innovations, further boosting GDP and creating a more inclusive economy.

Agriculture, especially when paired with technology and innovative investing, holds immense potential for boosting GDP. By supporting food and agtech startups through impact investing and venture capital, we can drive economic growth, promote sustainability, and champion a new generation of entrepreneurs.

As the food and agriculture industry continues to evolve, it presents a unique opportunity for investors and entrepreneurs alike to make a significant economic impact. Whether through impact investing or venture capital, there are many ways to contribute to the sector's growth while also driving positive change in the world.

About Our Partnership with Small Scale Food Processor Association (SSFPA)

Aligning the intention of impact investing to our mission of affording people of underrepresented genders opportunities to learn about and activate their investing and entrepreneurship potential, we’re thrilled to partner with the Small Scale Food Processor Association (SSFPA) on their Venture-Capital Ready: Investment Training for Women Entrepreneurs program.

Venture-Capital Ready is aimed at food industry women/intersectional entrepreneurs ready to present themselves and their business for investment and scale up to meet market demand.

Within the two-year program, M51 is facilitating a four-module investor curriculum to guide participants through the fundamentals of early-stage investing with a focus on impact investing and the Canadian food and agriculture sector.

Keep an eye out on our blog and social media to follow along with the modules and as we share more resources around impact investing, food and agriculture, and building the world we want to live in—today and for future generations.