How To Evaluate the Market Potential of a Startup

We're here to help you answer the question: what goes into selecting a winning startup? We'll look at key factors, such as market size, competition, target audience, and growth opportunities, to effectively evaluate a startup’s market potential before you start writing cheques.

As excited as you may be about the prospect of investing in startups, it’s crucial to assess and understand the market potential to make informed decisions and increase your chances of success.

Understand the Problem and Solution

First things first: to gauge a startup's market potential, you need to grasp the problem it aims to solve.

Consider the pain points and challenges faced by potential customers and how the startup's product or service addresses those needs. Has the founder truly listened to frustrations or “if only” statements that have come up in customer interviews?

Beyond that, is the problem significant? Is it widespread? Are customers actively seeking solutions? A startup that offers a unique and valuable solution to a more common or universally experienced problem is more likely to have a promising market potential.

Assess Target Market, Size, and Growth

Problem and solution identified, determine the size and growth of the market the startup is targeting. How big is the total revenue potential of the product or service? How fast is the market growing, and what drivers and trends are shaping it?

Take the FemTech sector, for example: software, diagnostics, products, and services that use technology to support women’s health. Due to bias and investors often wanting personal understanding of a product, this sector has been historically underfunded since most investment decisions are made by men (recall that only 21% of Canadian investors are women).

But FemTech is on the rise as a recognized and growing market. While it currently receives only 3% of all digital health funding, the global FemTech market size accounted for $40.2 billion in 2020 and is projected to grow and reach $75.1 billion by 2025.

Investors are looking for a business opportunity with growth potential. Analyze the market's growth potential and any barriers to entry that could affect the startup's ability to penetrate the market effectively.

Seek Market Traction and Validation

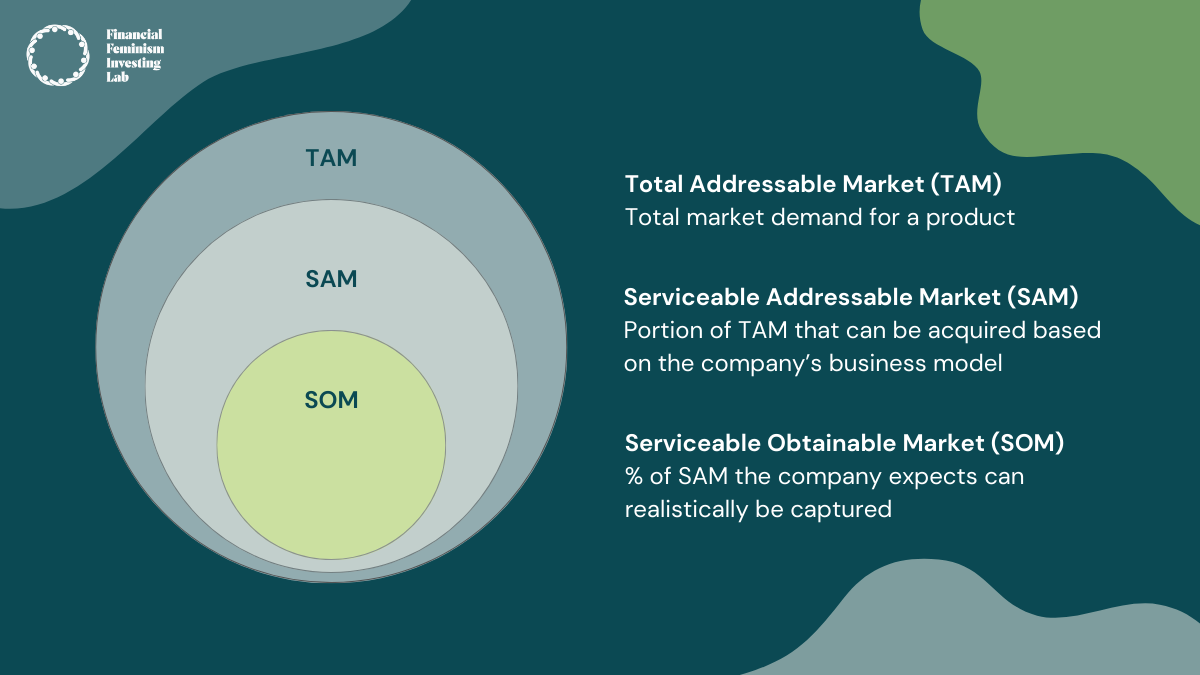

To know if a startup’s solution sticks, the idea has to prove its demand, the business model is working, and the market is positively responding to it—often calculated from three perspectives: TAM, SAM, and SOM.

Let’s start with the acronyms:

Total addressable market (TAM) refers to the total market demand for a product. It represents the entire market size or the maximum potential market size without considering any limitations or constraints.

Serviceable available market (SAM) represents the portion of TAM that can be acquired based on the company’s business model, focusing on the specific market segments or areas where a company intends to compete.

Serviceable obtainable market (SOM) is the percentage or share of SAM the company expects can realistically be captured. SOM is a more practical estimate of the market opportunity a company can achieve.

When looking for signs of validation and traction within the startup, inquire: Has it received funding from reputable investors? Are there early adopters or customers who have expressed interest or provided constructive feedback?

More evidence that the startup is gaining traction in the market might include:

Steady or accelerating revenue growth

Proven market-product fit

Strong customer growth

Proof-of-Concept (POC) convert to customers

Customer retention

Solid and consistent traction, validation, and early signs of success demonstrate a scalable business model and indicate a higher market potential.

Evaluate the Competitive Landscape & Defensibility

Competition plays a crucial role in determining a startup's market potential. What makes this startup’s product or service unique? How difficult will it be for other companies to catch up? How easily or quickly can a competitor or new entrant launch a similar product?

Let’s look at Glossier: a millennial makeup company and NYC unicorn.

Starting as a beauty blog in 2010, Glossier entered the unicorn club with a valuation of $1.2 billion by 2019. Emily Weiss built her business focused on simplicity, inclusivity, community engagement, skincare, and a direct-to-consumer model—all of which have contributed to its wild success and popularity among millennial and Gen Z consumers.

Research and analyze the competitive landscape to identify direct and indirect competitors. Assess their strengths, weaknesses, and market share.

To survive—and thrive—in a competitive market, startups need a strong unique selling proposition (USP) and a differentiating factor (don’t forget: roughly 20% of startups fail in their first year and 60% in their first three).

Analyze the Team and Execution

Here’s a sneak peek at something we always mention in our programming: “It’s better to invest in an A Team with a B Product, than a B Team with an A Product.”

Why? Ideas are often in flux. An A Product/Idea now might not be an A Idea six months or one year later.

Data shows that 60% of new ventures fail due to problems with the team. Having the right people and talent in place shows that the startup has the human capital to execute and succeed.

Assess the founders' expertise, relevant industry experience, and track record, and consider their ability to navigate challenges, adapt to market conditions, and pivot if needed.

Ask key questions like:

What are the team’s experience levels and leadership skills in this field?

Do team members have specific domain expertise?

What’s the team’s commitment to the startup?

Do team members have complementary skills (technical vs commercial)?

Is the team complemented by strong Advisors or Board Members?

Who are the team’s allies and champions? How effective are they?

A competent and experienced team increases the likelihood of effectively capturing the identified market potential and determines if they can successfully execute the vision they have articulated.

Conduct Due Diligence

Including all the points mentioned and diving even deeper, thorough due diligence raises any red flags to help select the potential winners.

The aim of due diligence is to test your initial expectations, identify risks, and confirm your initial valuation and intention still make sense.

Review the startup's financials, including revenue projections, costs, and funding requirements. Assess the startup's intellectual property, legal agreements, and potential risks or liabilities.

With all the data in front of you, ask:

Is it all there? Do you have all the information you need to make an informed decision?

Does it flow? Do individual elements of the plan align with one another in a logical manner (e.g. marketing strategy aligns with sales forecast reflected in financials)?

Do you believe it? Is it plausible (assumptions, scenarios, etc.)?

Does it make sense? Are core elements (problem, core value proposition, go-to-market, competition) easily understood?

Knowledge is power in due diligence. If needed, seek expert advice to ensure you have a comprehensive understanding of the startup's overall viability.

There you have it—a quick overview of what goes into selecting a winning startup.

Evaluating the market potential of a startup is crucial for aspiring investors. By understanding the problem the startup solves, assessing the target market, seeking validation and traction, evaluating the competitive landscape, analyzing the team and execution, and conducting due diligence, you can make more informed investment decisions.

Remember: investing in startups involves risks, but a thorough evaluation of market potential can increase your chances of success.

This topic was covered live in our webinar: Anatomy of an Early-Stage Startup!

Presented by George Damian, investor and advisor to early-stage startups, he walked us through what an early-stage startup was and dissected its key factors.

Looking to learn more about early-stage investing? Registration for the Fall Cohort of Movement51’s Financial Feminism Investing Lab is open!

You can expect to dive deeper into topics like this one—further unpacking and understanding what we’ve flagged as the seven core elements of due diligence.

And this is only scratching the surface of what you’ll learn about angel investing to take away the intimidation around early-stage investing.

Run in collaboration with the Haskayne School of Business, University of Calgary, FFIL introduces participants to the ins and outs of early-stage investing and teaches aspiring investors how their dollars can power the next generation of future-fit, feminist businesses.

*Please note that the information provided in this blog is for informational purposes only and should not be construed as investment or financial advice.